Pawnbroking has ancient roots, emerging in diverse forms across cultures. In 5th-century China, Buddhist monasteries pioneered the practice, later partnering with wealthy laypeople during the Southern Song dynasty to open tax-exempt pawnshops. By the late Qing and Republican periods, pawnbrokers employed strategies like philanthropy and social relationship building to expand their reach and improve their reputation. In ancient Greece and Rome, pawning was a common practice with many professional pawnbrokers operating private shops. Roman law regulated the types of items that could be pledged, and Emperor Augustus even created a state-run interest-free lending system based on pawned valuables.

In medieval Europe, pawnbroking was often associated with Jewish and Christian lenders, despite Church opposition. Jewish pawnbrokers in England initially played significant roles, including financing the Crown, but were later expelled in 1290, making way for Lombard merchants. These Lombards supported English monarchs like Edward III and Henry V, who pawned royal jewels to fund military campaigns. This history reflects the evolution of pawnbroking as a means of economic support, shaped by religious, social, and political contexts.

Pawnbroking as a profession has served as a financial lifeline with short term loans for individuals across cultures and eras. After early practices, the rise of the powerful House of Medici in Renaissance Italy truly began the emergence towards today’s regulated pawn shop industry, continually evolving to meet society’s changing needs. Read on to understand the rich history of pawnbroking and the global spread of pawnbroking, illustrating its cultural and economic impact through the centuries.

The Origins of Pawnbroking and the House of Medici

The House of de Medici stands as one of the most influential families in European history, recognised for pioneering early banking and pawnbroking practices. Established in Florence during the 14th century, the Medici family gained prominence through innovative financial systems that would later shape the future of European finance. Their approach to secured lending is a cornerstone of modern pawnbroking, creating an enduring financial legacy.

The Medicis were instrumental in the development of secured loans, a method central to pawn transactions today. Unlike contemporary pawn shops that serve individuals, Medici banks financed rulers, merchants, and officials, using collateral such as precious metals, estates, and other high-value assets. This established the Medici family as trusted financial leaders across Europe. As prominent art patrons and political figures, the Medicis leveraged their financial influence to cultivate Florence’s growth as a hub of commerce and culture. Their extensive financial network allowed them to offer services beyond Italy’s borders, cementing their role in European prosperity and demonstrating the value of secured lending in fostering wealth and stability. The Medici dynasty laid the foundations for modern pawnbroking, setting standards in trust and wealth management that endure to this day. Their impact on collateral-based lending has transitioned from large-scale projects to meeting personal financial needs, illustrating how the Medici influence continues to shape the world of finance.

Medici Statue

The Meaning of Lombard and Global Influence

The term “Lombard” has a deep-rooted history in European finance, originating from the Lombards of Northern Italy. Known for their extensive trade and banking skills, the Lombards were influential in establishing financial practices that shaped early European commerce. In the medieval period, they travelled widely across Europe, becoming prominent in the world of finance and lending. They set up lending stations throughout the continent, introducing many aspects of secured lending and collateralised loans, the foundation of what we now associate with pawnbroking and secured finance. As their financial influence spread, “Lombard” became synonymous with banking and lending practices, and the term took on broader significance in financial centres worldwide. Lombard Street in London is perhaps the most notable example of this legacy. Serving as the heart of London’s financial district for centuries, Lombard Street became known as the primary centre for European pawnbrokers and merchants. Here, Lombard banking practices and collateral-based lending helped shape the principles of modern secured loans, including Lombard credit, Lombard lending, and Lombard business finance, making it an essential aspect of global financial systems. Today, the Lombard legacy endures, with “Lombard loans” referring to loans secured against high-value assets or collateral. This practice, originally popularised by Lombard merchants, has influenced both European and international financial markets. The Lombard Bank not only laid the groundwork for collateral-based lending but also contributed significantly to the development of financial networks and wealth management practices across the world. The name “Lombard” remains a symbol of enduring influence in the financial industry, embodying the evolution of global finance from its medieval roots to contemporary practices.

Lombard Street London

‘The Great Leap Forward’: Transforming the Industry

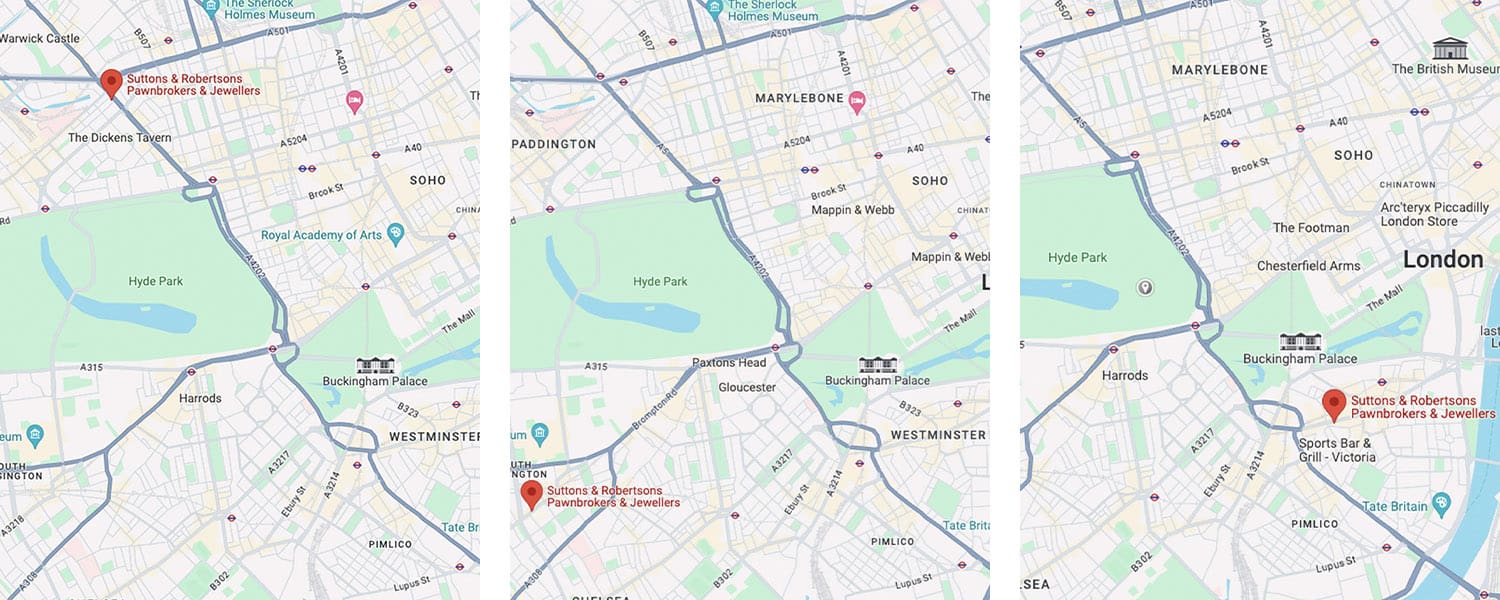

The evolution of pawnbroking in London and the broader UK reflects a dynamic industry that has continually adapted to changes in regulations and shifting public perceptions. Known for centuries as a lifeline for those needing immediate financial solutions, the British pawn shop was once seen as a last resort. However, the “Great Leap Forward” in pawnbroking marked a decisive transformation towards a regulated, reputable, and customer-centric industry, aiming to distinguish pawnbrokers in the UK from informal or unregulated moneylenders. With changes in financial regulation, pawnbroking firms embraced a professional ethos that helped reframe their role in society and build trust among a wider customer base. In London, the heart of British pawnbroking, pawn shops began focusing more on providing ethical and transparent services, establishing a clear framework for transactions based on collateral and fair loan terms. This shift also included clarifying for customers what “pawn” means—not just as a financial tool but as a respected, reliable solution for managing short-term financial needs. Pawn shops in London UK have since built strong relationships within their communities, enabling customers to secure loans against valuables, ranging from jewellery and electronics to more unusual items, while maintaining transparency around terms, fees, and reclaiming collateral. The Great Leap Forward has given the pawnbroking industry in the UK a renewed reputation, drawing a diverse clientele, from individuals managing unexpected expenses to collectors and investors. This transformation has positioned British pawn brokers as viable, trustworthy financial institutions, especially in challenging economic climates. Today, London’s pawn shops stand as testaments to how traditional practices can evolve and gain respect through integrity, service, and professionalism, continuing to play a valuable role in the financial lives of many such as our three pawnshops in London as well as online.

Suttons & Robertsons Pawnbroking Stores London – Edgware Road, South Kensington & Victoria Street

The Evolution of Pawnbroking in London

Pawnbroking, often seen as a last resort for quick cash, has a rich history intertwined with London’s economic landscape. This financial practice dates back centuries, evolving from a simple barter system to a complex industry that plays a crucial role in today’s economy. High-end pawnshops have emerged, lending a fresh breath of life to the trade. Nestled within the posh locales of Mayfair, South Kensington and Hatton Garden, these establishments have created a world where authentic luxury items and valuable antiques find their rightful place. Let’s take a closer look at the journey of pawnbroking in London and its significance in modern finance.

Origins of Pawnbroking

The roots of pawnbroking can be traced back to ancient civilisations, where people exchanged goods for immediate cash. In London, this practice began to take shape in the Middle Ages. By the 15th century, pawnbrokers were formally recognised, often operating out of shops and lending money against personal belongings, which served as collateral. These early pawnbrokers provided a vital service, especially for the working class, allowing them to access funds without the burdensome process of traditional banking.

The Rise of the Pawn Shop Sign

As pawnbroking developed into a formal industry, the symbolic pawnbroker sign became an iconic part of London’s urban landscape. This symbol, typically three golden spheres suspended from a bar, was originally associated with the Medici family and signified the ability to secure loans against valuable items. Pawnbrokers in the UK adopted this emblem, marking their establishments as trusted places where individuals could obtain a pawn shop loan quickly and discreetly.

Over time, the term “pawnshop” came to represent more than just a place of lending. The meaning of pawn became associated with accessible financial help, offering pawn lending services for those facing short-term monetary needs. Today, the definition of pawnbroker goes beyond loan services; modern pawn shops also serve as retail spaces, offering second-hand watches and pre-loved jewellery for sale. This dual role continues to support people in managing both immediate financial demands and long-term financial planning.

What Does it Mean to Pawn?

To “pawn” an item means to use it as collateral in exchange for a loan. In UK pawn shops, the ‘pawning meaning’ involves temporarily transferring custody of an asset to the pawnbroker until the loan and any associated fees are repaid. If the loan isn’t repaid within the agreed-upon time, the pawnbroker may sell the item to recover the funds. This process provides a fast and convenient method for securing cash without formal credit checks, appealing to individuals who may lack access to traditional loans.

Understanding how pawn shops work involves recognising the simplicity of the transaction: customers bring an item of value, and in return, the pawn broker offers a loan based on the item’s assessed value. After evaluating the item, the pawnbroker provides an offer, and if accepted, the customer receives cash immediately. Pawn shop customers may retrieve their belongings once the loan is repaid, allowing them to meet short-term financial obligations without permanently parting with their assets.

The Pawn Shop Business Model

The pawn shop business model is based on a few key principles: securing loans against valuable items, storing them safely, until customers recover them once they have the necessary funds. This model has adapted over time, and in London pawn shops and beyond, pawnbrokers now offer services that include jewellery repairs, appraisal services, and buy-and-sell transactions.

Pawn shops often attract a diverse clientele, from individuals seeking short-term loans to collectors and investors in search of unique items. The appeal lies in the flexibility of pawn shop loans and the absence of stringent credit checks, which provide customers with a discreet and straightforward way to access funds. In addition, many London pawnbrokers now offer pawnshop lending services tailored to specific items, such as gold, art, and high-end watches and jewellery.

Pawning in Modern Times

In recent years, pawnbroking has experienced a resurgence in popularity, with UK pawn shops adapting to digital technologies and expanding their services. For example, many pawn shops in the UK now provide online appraisal services, allowing customers to assess their valuables without needing to visit a pawn shop in person. This shift has made pawn shops more accessible to a wider audience and has contributed to the industry’s growth in the digital era.

With the influence of reality TV shows such as Pawn Stars UK and Million Pound Pawn, the industry has gained mainstream attention, showcasing the variety of items brought into pawn shops and the unique stories behind them. These programs have demystified the pawn shop process, revealing that pawnbroking is about more than pawned items—it’s about valuing people’s stories and helping them navigate financial challenges. As a result, pawnbrokers in the UK have become more widely respected, serving as trusted financial institutions that support individuals and families during times of need.

Pawn Shops as Financial Cornerstones

The pawn shop industry has come a long way from its historical roots, evolving into a respected part of modern finance. For those wondering, “What is a pawnbroker?” or “What is a pawn shop?” it’s a place that offers quick, secure loans without the red tape of traditional banking. In cities like London, pawn shops and pawnbrokers play a vital role in providing accessible financial solutions, allowing customers to obtain immediate cash by using their valuables as collateral.

In an ever-evolving financial landscape, pawnbroking remains a valuable option for those seeking a fast, trustworthy way to access funds. Whether you need a loan against gold, an appraisal, or simply want to understand how pawning works, pawn shops in the UK and across the world stand ready to assist. From the historic House of Medici to the bustling streets of London, the legacy of pawnbroking endures, proving that this ancient financial practice is here to stay.

FAQs About Pawnbroking and Its History

What is a pawnbroker? A pawnbroker is a licensed individual or business that provides loans against valuable personal items, such as jewellery or electronics, as collateral. If the loan isn’t repaid within the agreed time, the pawnbroker may sell the item to recoup the loan amount.

How do pawn shops work? Pawn shops operate by lending money in exchange for items of value. The customer can reclaim their item by repaying the loan, or the pawn shop may sell the item if the loan isn’t repaid. This practice of pawning provides a short-term solution for financial needs.

What is the history of pawnbroking in the UK? Pawnbroking in the UK dates back to medieval times, gaining prominence in the 17th and 18th centuries as pawnbrokers expanded their influence. In London, famous pawn shops and the House of Medici helped establish pawnbroking as an essential service.

What does ‘to pawn’ mean? To pawn means to offer an item of value as security for a loan. If the loan isn’t repaid, the pawned item may be sold by the pawnshop.

What is Lombard lending? Originating from Lombard merchants in Italy, Lombard lending involves securing loans against valuable assets, a practice that remains central to modern pawnshops and banking.

How has the British pawnbroking industry evolved? British pawnbrokers today are regulated and customer-focused, offering fair, ethical services. Major cities like London and Bristol have become hubs for the pawn and loan industry, where customers seek secure, collateral-based loans.

Pawn Your Items With Suttons & Robertsons

With us, you can pawn your luxury watches and jewellery for a quick and easy way to receive funds. With over 250 years of experience, we offer expertise in the watch and jewellery industry so you can be assured that your items will be kept safe in our vaults while they are with us. Use our pawnshop lending service and you can receive cash in as little as an hour.

Discover our pawn vs sell guide to find out which option is best for you.