What Is An Alternative Investment?

It is said that money should never sleep; that it should be hard at work rather than languishing in an account somewhere. When running through the Best things to invest in 2025, it can be tempting to head straight for typical investments, such as stocks and shares. However, these types of investments are tied to the markets with their performance intrinsically connected to global money markets. Alternatively, taking guidance from annual resources such as the Knight Frank Wealth Report can help you maximise your finances by focusing on tangible, desirable investments, particularly when exploring passion assets.

Smart investors have always had their finger on the pulse of alternative investments and their opportunities opportunities. They have a solid understanding of which alternative investments are on offer, and they are savvy enough to be able to tap into the opportunities that these can offer them. Free from market ties, these alternative assets shift the focus away from traditional stocks and encourage investors to broaden their perspectives when considering the best investments in 2025.

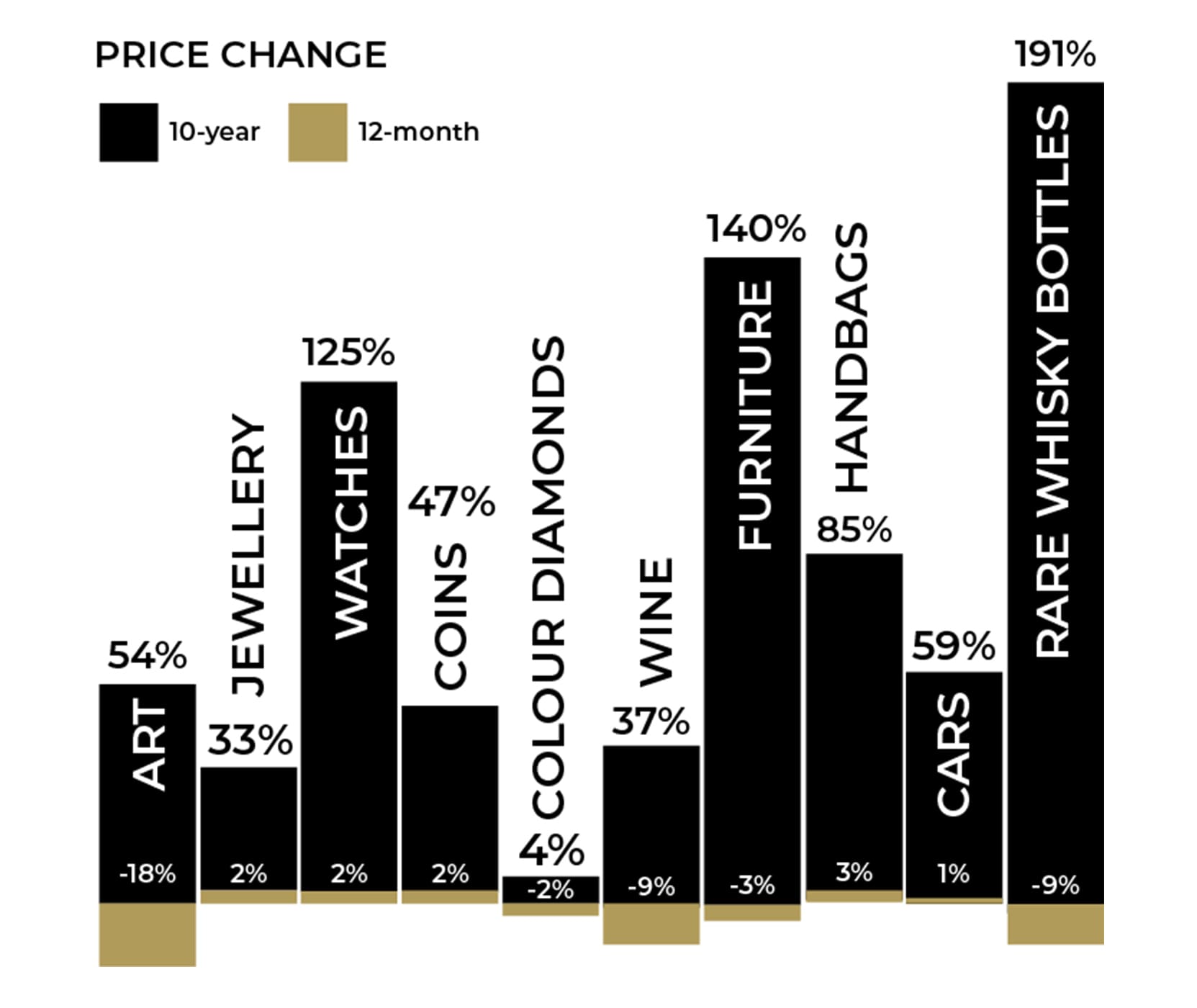

KNIGHT FRANK WEALTH REPORT 2025

A great starting point for understanding Best investments in 2025 is the Knight Frank Wealth Report. This is an annual report that charts the performance of money around the world, particularly when it comes to luxury residential’s such as Million Pound Homes and commercial markets. It identifies the hot spots for property investment globally, shows wealth distribution around the world and seeks to uncover where the smart money is being spent and what on. Useful for an investor looking for the best items to collect in the UK, the Knight Frank Wealth Report takes the temperature for Ultra High Net Worth Individuals (UHNWI) and sets the scene for best alternative investments for any given year.

Also known as investments of passion, the Knight Frank Luxury Investment Index (KFLII) tracks the value of 10 such investments, including wine and classic cars. The Index offers easy analysis of the performance of alternative asset examples, looking for trends and highlighting outstanding results in each category.

While the KFLII recorded a modest decline of 3.3% in 2024, this reflects a natural recalibration following years of strong growth. As financial markets soared, some categories, such as fine art and wine, experienced corrections, allowing collectors and investors to identify fresh opportunities in a shifting landscape. Rather than diminishing the appeal of passion assets and collectible objects, this shift signals a more discerning market where quality, rarity, and provenance will increasingly drive long-term value. Therefore, for those seeking best collectables to invest in, this drop in overall alternative investments should not deter the purchasing of assets and categories like decorative collectables and rare collectables which continue to hold promise, especially for investors focused on securing best luxury investment pieces.

Graph Detailing The Knight Frank Wealth Report 2025 Results

The Best Performing Alternative Investments Of 2024

The index assesses the types of investment for their “collectability”, with five of the assets analysed witnessing growth in the last year.

Handbags have proven to be recession-proof, with a 2.8% increase in 2024, making them one of the top-performing luxury assets of the year. The Knight Frank Wealth Report 2025 highlights luxury bags as a standout performer in the luxury investment index. With values consistently rising, especially for iconic brands like Hermès, Chanel, and Louis Vuitton, luxury handbags are increasingly viewed as some of the best luxury investment pieces. So, are luxury bags an investment? The answer to this question is a resounding ‘yes!’. With vintage and limited-edition models continuing to fetch record-breaking prices at auction.

Jewellery continues to shine as a solid investment, with a 2.3% increase in 2024, making it another top contender for 2025. According to the Knight Frank Wealth Report, investment jewellery from luxury brands such as Cartier and Van Cleef & Arpels remains in high demand. High-quality, rare pieces are considered passion assets, offering both beauty and financial return. As one of the best things to invest in 2025, it’s clear that investment jewellery is a reliable option for diversifying your portfolio.

Gold coins are a stable and enduring asset, with a 2.1% increase in 2024, benefiting from the rise in gold prices. As a key player in the Knight Frank Wealth Report, gold coins continue to be a wise choice for investors seeking alternative assets examples. With their consistent appreciation, gold coins are undeniably among the best collectables to invest in in 2025, offering a safe and reliable store of value.

The Knight Frank Luxury Investment Index 2025 reaffirms the strength of handbags, jewellery, and gold coins as best things to invest in 2025, making them essential assets for those looking to invest in luxury and diversify their portfolios with luxury investment opportunities. With other modest performers in 2025, there are key assets that present opportunities to grow and expand your asset portfolio with ease. Our overview of alternative investments highlights what’s worth considering and why. As well as gold coins, investing in silver coins or pawning silver is also a good option. From January 2024 to January 2026, the price of silver has risen by almost 300%.

Hermès Black Epsom Leather Sellier Kelly Handbag

What Are The Best Investments In 2025?

From Fashion To Fortune: How Luxury Handbags Are Emerging As Top Investments For 2025

Are luxury handbags a good investment? With an 85% appreciation over the past decade and a 2.8% increase in 2024—the highest across 10 collectible objects measured by the Knight Frank Wealth Report—luxury handbags have proven to be a rewarding alternative asset. Deemed “recession-proof” by finance experts Credit Suisse and Deloitte, designer handbags from brands like Hermès and Chanel consistently appreciate in value, much like high-end luxury watches.

The majority of growth in this sector is driven by a select few producers, particularly Hermès, whose iconic Birkin and Kelly bags remain some of the best luxury bag investment options. Recent auction results further demonstrate the strength of this market. In mid-September 2024, Yayoi Kusama’s Louis Vuitton Pumpkin Bag sold for a record $151,200, highlighting the immense demand for rare collectables.

While many people buy second hand designer handbags for their aesthetic appeal and personal enjoyment, a well-curated collection can be worth hundreds of thousands—and is increasingly recognised as one of the best investments in 2025 for its potential to appreciate in value. For those looking to invest in luxury, handbags not only hold their value but in recent years have also outperformed other alternative assets examples, functioning as the perfect asset for quick release loans. With increasing global demand and limited supply, these collectible objects remain a top choice for discerning investors seeking stability and high returns.

1957 – 1968 Queen Elizabeth II Gold Sovereigns

Go For Gold In 2025

With record high gold prices in recent months, observable with the Royal Mint’s Gold Price Tracker, many investors are considering whether now is the right time to sell. Due to ongoing economic instability, gold investments have surged in value, making gold an appealing option for those seeking stability. While buying gold may seem expensive, those asking, “Is buying gold bullion a good investment?” will find that its tangible nature offers security that intangible assets often lack. As highlighted by the Knight Frank Wealth Report, gold has a long history of surviving economic downturns and maintaining its value during recessions. For instance, while oil prices plummeted during the pandemic, gold prices soared, proving its resilience in turbulent markets.

For those exploring the best gold investments in the UK, gold coins present an excellent opportunity. With a 2.1% increase in 2024 and a 47.5% increase over the last decade, gold coins offer steady growth and accessibility, making them an ideal choice for both novice and seasoned investors. Those wondering, “Are gold coins a good investment?” will find that they provide a reliable avenue for wealth preservation and growth. To learn more about gold assets and potential returns, check out our Invest in Gold for Beginners Guide, which highlights practical insights into passion assets and how to navigate this rewarding market.

Gold’s liquidity marks it as an asset that can be transformed into cash very quickly, from selling jewellery to taking a secured loan on your gold.

Cartier Vendôme Louis Wedding Ring 18ct Gold

Why Jewellery Remains A Strong Investment For 2025

The success of jewellery investment is closely tied to gold prices, making gold jewellery an excellent choice for an alternative investment. Moreover, while high-end jewellery encapsulates the genesis of success, it seems to appreciate over time, especially if your jewellery has been produced by one of the great houses, such as Tiffany & Co., Cartier, or Boodles. According to the Knight Frank Wealth Report 2025, jewellery demonstrated a 2.3% appreciation in 2024 and an impressive 33.5% increase over the past decade, highlighting its consistent growth as a tangible asset.

So, “Is jewellery a good investment?”, the data suggests that gold jewellery from renowned jewellery brands offers worthwhile returns, both for special edition collectors’ items and iconic collection pieces. If you’re interested in expanding your luxury investment portfolio, buying secondhand luxury branded jewellery is a great way to acquire the best investment jewellery at competitive prices. As highlighted in the Knight Frank Luxury Investment Index 2025, luxury jewellery remains one of the best things to invest in 2025, making it an attractive option for those seeking both aesthetic pleasure and financial security.

1965 Rolex GMT & Rolex Cosmograph Daytona

Consistently Ticking Towards Success—Investing In Watches

Luxury watches remain one of the best investments in 2025, with the Knight Frank Luxury Index reporting a 1.7% appreciation in 2024 and an extraordinary 125.1% increase over the past decade. For those considering the best luxury watches for investment, high-end brands like Patek Philippe, Rolex, Cartier, Breitling, and Omega offer exceptional opportunities for value growth.

As evidence of the incredible investment potential of watches, a Patek Philippe Grandmaster Chime secured $5,400,000 at auction in June 2024, firmly establishing that watches more than secure their place as a good investment for 2025 for UK investors. Introduced in 2016 as Patek Philippe’s first grande sonnerie in its permanent collection, this extraordinary timepiece features twenty complications, five chiming modes, and a reversible case—a testament to the brand’s horological mastery. This particular Grandmaster Chime had once belonged to Sylvester Stallone, and came accompanied with a presentation box, literature, and numerous accessories, which may have contributed to its auction-house success, but it can’t explain away the consistently appreciating interest and performance across other luxury watch brands.

These impressive auction results demonstrate that watches are far from mere timepieces. High-end watches, and Swiss watches in particular, will always attract interest and hold their value because they not only represent an effortless statement of wealth but also showcase craftsmanship and immense skill. For those wondering about the best watches to invest in or generally considering investing in luxury watches, these examples underscore the potential for extraordinary returns. As passion assets, luxury watches not only hold their value but also offer impressive appreciation, making them a compelling option for alternative investments in 2025 and beyond. Additionally, buying second-hand watches provides an accessible entry point into the market, allowing new collectors to invest in luxury at a lower cost while still benefiting from long-term value growth.

Silver Mercedes 300SL Gullwing

Classic Cars—The Best Investment In 2025?

Classic car investments offer a unique blend of passion and smart decision-making, making them one of the best investments in 2025. While some may view luxury car investment as experimental in portfolio diversification, recent performances suggest otherwise. With a 10-year increase in value and a 1.2% growth over the last 12 months, investing in classic cars during a period of modest appreciation remains both an enjoyable and astute choice.

Whether a car’s value stems from its exceptional design and engineering or its place in pop culture—such as Mr. Bond’s iconic Aston Martin DB5—it pays to know which models are worth the investment. While modern supercars may leave the forecourt with million-pound price tags, preowned vintage and classic cars are achieving record-breaking results at auction. A prime example is the 1955 Mercedes 300 SLR, which sold for over $143 million in 2022. Similarly, in August, 2025, a 1960 Ferrari 250 GT SWB California Spyder by Scagletti fetched US$17 million at RM Sotheby’s. Ultimately, if you’re wondering “Are luxury cars a good investment?”, the answer lies in their consistent value appreciation and desirability among collectors.

Using trusted resources like the Knight Frank Wealth Report can help you identify the best classic car investment opportunities and capitalise on this lucrative sector. Additionally, luxury cars can be easily pawned for quick loans, offering a flexible way to leverage their value without a long-term commitment.

Navigating Market Corrections—Opportunities In Passion Assets

Market corrections often create unique opportunities for savvy investors, particularly those looking beyond traditional assets. As financial markets fluctuate, tangible investments such as collectible objects and rare collectables become increasingly attractive, while dips within investment growth offer the perfect opportunity to invest in the market. These passion-driven assets offer stability and the potential for long-term appreciation, making them an appealing alternative during periods of economic uncertainty.

The Knight Frank Wealth Report and The Knight Frank Luxury Investment Index consistently highlight the strong performance of luxury assets, showcasing how collectibles like fine art, watches, and classic cars have outperformed traditional investments over the years. As the market recalibrates, these tangible assets provide a hedge against volatility while offering the added benefit of emotional and aesthetic satisfaction. Based upon the results of the Knight Frank Wealth Report 2025, some of the best things to invest in 2025 may actually be passion assets that have underperformed this year.

Museum of Fine Arts, Boston

Fine Art: A Dip Or A Chance To Diversify?

Art has always been viewed as a solid and very viable alternative to conventional investments. Art’s value lies in the worth the collector places in it. In addition to the fact that art investment is unassociated from market performance, it most often remains unimpacted by the economic climate globally. Currently, art is not only displaying continued appreciation over time – charting a decade-long increase – but art has always been regarded as a credible passion asset. Each year is marked by a top-performing piece at auction, and 2025 was no exception. In 2024, the top-performing art piece at auction was René Magritte’s L’Empire des Lumières (1954), which sold for $121.2 million at Christie’s New York, setting a new record for the artist.

In recent years, fine art has been a strong investment, but 2024 saw a notable drop of -18.3%. Despite this, art’s value has still appreciated by 54% over the past decade. According to the Knight Frank Luxury Index, this devaluation is largely due to structural changes in the art market, including shifts in how art is marketed and changing demand towards decorative collectables. Auction volumes fell significantly in 2024, impacting values. However, contemporary and female artists saw strong growth, for example, Maurizio Cattelan’s duct-taped banana was sold for over US$6 million at Sotheby’s in November.This depreciation could indicate an imminent surge in value, making it an ideal time to step onto the art investment ladder.

Investing in art can also represent a smart move for hands-off investments. Many high value artworks are never displayed, instead being held in secure storage. With art incurring taxes and shipping costs during movement, and some art investors purchase their pieces and leave them in storage. Art holds its value, ready for release on sale or a secured loan against the asset’s value. This makes art one of the best luxury investments in 2025, alongside other collectible objects and rare collectibles.

Petrus Pomerol Collection

Rare Whiskey And Wine: Short-Term Declines, Long-Term Potential

Rare whiskey and fine wine have long been regarded as passion assets that combine pleasure with financial gain. Over the past decade, rare whiskey appreciated by an impressive 191.7%, while fine wine rose by 54%. However, 2024 saw a correction in both markets, with rare whiskey values dropping by -9% and fine wine experiencing a -9.1% decline. According to the Knight Frank Wealth Report, this downturn was expected due to market adjustments following a decade of strong growth.

Rare whiskey, which had its second poor year in 2024, saw a decline due to a rapid influx of stock returning to the secondary market. Prices are now down 19.3% from their 2022 peak, presenting an exciting opportunity for discerning investors. As demand stabilises, experts believe this correction has opened the door for long-term value appreciation, making it one of the best things to invest in 2025 for those looking to invest in luxury.

Similarly, fine wine faced headwinds, with changing consumption patterns and overstocking contributing to the decline. According to the Knight Frank Luxury Investment Index, the fine wine market had surged during the Covid era due to low interest rates and speculative buying, with Champagne and Burgundy in particular seeing dramatic price increases. However, with traditional collectors well-stocked and the Chinese market slower to rebound, prices have corrected, offering a prime moment for new investors to enter the market.

Both markets, despite recent corrections, remain among the best luxury investment pieces in 2025 and overall best collectables to invest in. As values stabilise and demand gradually rebounds, these collectible objects offer exciting potential for growth, solidifying their place in the Knight Frank Wealth Report 2025 as some of the best investments in 2025.

Release The Value In Your Alternative Investments

Thinking about how you can further optimise an existing investment? At Suttons and Robertsons, we have experts that excel in many of the alternative asset markets, whether that be a watch, a work of art or a classic car. If you have a luxury asset that you would like to release funds from, simply walk in or make an appointment we can have a valuation for a loan offer with you in 24 hours. Contact us today.