Sell Gold and Pawn Guide 2025

Introduction

Gold is well established as an enviable asset, both for it’s intrinsic beauty in jewellery design and for it’s long standing value as a precious metal. Throughout history, gold has been used as a form of currency, a symbol of wealth and power, and a hedge against economic uncertainty. Buying, selling and pawning gold have long been popular practices for individuals looking to invest, secure quick cash, or simply admire and possess this precious metal. In 2025 interest in pawning gold and selling gold has escalated, driven by new records in the gold spot price and associated pawn gold price per gram UK. Indeed, the gold selling rate today remains close to the very recent all time high. In this comprehensive gold pawn and selling guide, we’ll delve into the considerations when selling gold or securing a loan through gold pawn brokers. We explore everything from understanding its value, to practical steps and confidence in selling gold or pawning gold.

1. Pawning gold versus selling gold

If you wish to leverage the value of your gold, one of the first considerations is whether to pawn or sell gold.

Sell Gold

Selling gold provides the opportunity to gain immediate value in exchange for the asset, usually the biggest motivation to sell gold. For gold in the form of jewellery this benefit does however need to be balanced with other factors such as sentimental value or potential emotional impact for a partner or later generation. The value of a gold heirloom ring for example goes way beyond financial form.

When selling gold jewellery the valuation will be dependent upon the buyer’s subsequent intent. For items with no perceived onward retail appeal, the scrap value of gold is most likely to apply, whereas some vintage pieces or popular designs, particularly items by luxury brands such as Cartier, will be valued based upon likely resale gain. Research any similar items for sale in Gold Pawn Brokers or second hand jewellery traders to understand potential value and be prepared for your gold selling negotiations.

The other implication is timing – the live price of gold or gold spot rate, administered by the Royal Mint, fluctuates, and similarly to the stock exchange, this may result in a higher value for a gold asset at a later date. This point is equally valid if you wish to sell physical gold or digital gold. Is now a good time to sell gold? As well as jewellery, physical gold could be gold coins, gold bullion or other forms of gold for investment.

Pawn Gold

As with selling gold, pawning gold enables immediate access to value. The difference being that your physical gold asset/s is/are surrendered to act as security for short term lending and is/are returned once the loan is repaid. You remain the legal owner and therefore retain the asset to keep or to sell at a later date, subject to no default upon the loan. This form of lending requires no credit checks, is discreet and attracts competitive interest rates compared with other instant cash loan alternatives, for example Pay Day Loans. During the period in which pawned gold is in the custody of a gold pawn broker it will typically be held in secure vaults providing reassurance that prized gold possessions are well protected. Gold pawn brokers will offer loans against jewellery, gold coins and gold bullion.

The Decision to Sell or Pawn Gold

Ultimately the decision to sell gold or pawn gold is largely predicated upon whether financially you simply require short term access to funds or whether you are willing to relinquish your gold valuable through permanent sale. Either option provides instant access to cash. A gold pawn broker will both buy and pawn gold and so if you are unsure, they can advise on both options to help you reach a conclusion. Our own Pawn vs Sell Guide is also available to help you consider selling vs pawning gold.

2. The Value of Gold – Gold Selling Rate Today

When venturing into the realms of buying and pawning gold, it’s crucial to grasp how gold is valued and how to get the best from your investment. Gold’s value is determined by its purity, weight, and prevailing market prices.

Gold Carats and Hallmarking

The purity of gold is measured in carats, with 24 carats being the purest form. However, gold in its purest form is considered too soft for practical use, so it’s often alloyed with other metals to increase durability. Commonly traded forms of gold include 24ct, 22ct, 18ct, 14ct and 9ct, each denoting a different level of purity.

This ‘caratage’ represents the amount of pure gold alloyed with other metals such as copper or silver. As to be expected, pure gold is the most valuable with the lower the carat the lower the cost, for example the cost of 14 carat gold is lower than 22 carat gold. Most jewellery buyers will be familiar with the expression gold carat, with jewellery in the UK most commonly being available in 18ct or 9ct gold. Examples of the percentage of gold within carat measurements are: 22ct = 91.6%, 18ct = 75%, 14ct = 58.3% and 9ct = 37.5%.

The minimum percentage for metal to be considered gold varies by country and validation through hallmarking also differs globally. In the United Kingdom gold and other precious metal hallmarking is managed by Assay Assured guaranteeing the purity of items made from precious metals.

“Testing and hallmarking precious metals for over 700 years”

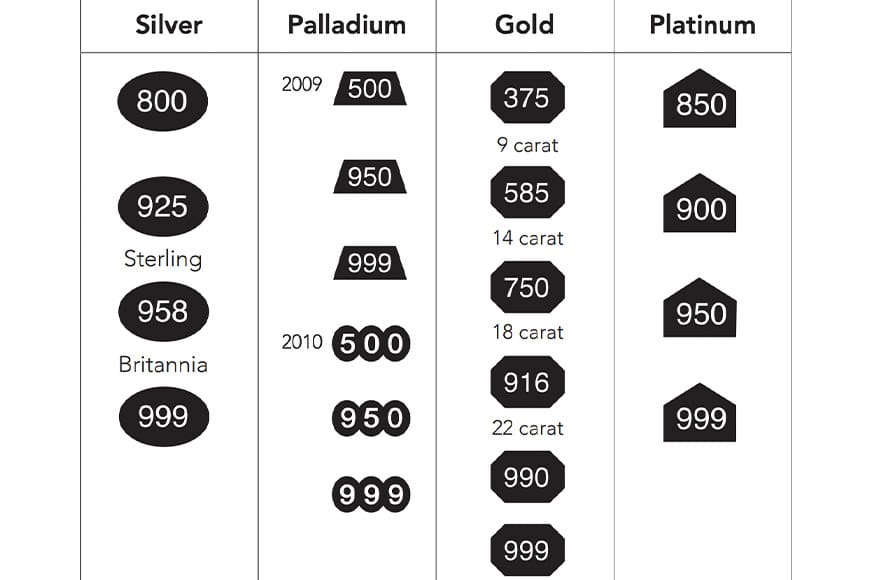

In the United Kingdom hallmarking covers gold, silver, platinum, and palladium. For gold, ‘fineness’ marks are included within the hallmark to represent the gold carat as shown in the table below. There is a direct relationship between the gold carat, eg 18ct gold at 75% has a fine mark of 750.:These ‘fineness’ marks are coupled with other engraving to create a full hallmark. The other elements are the ‘makers’ mark and the Assay Assured mark. The latter is specific to the hallmarking Assay office London, Edinburgh, Sheffield or Birmingham.

Gold Selling Rate Today

The gold buying or selling rate is based upon the LBMA gold spot rate, administered by ICE Benchmark Administration (IBA). IBA independently administers the price and provides the auction platform on which the LBMA Gold Price is calculated, while LBMA own the intellectual property rights.

As previously mentioned the gold spot rate is currently peaking with all time highs. This follows an extended period of strong performance seeing gold playing a key part in many investment portfolios for those adopting it as a ‘safe-haven’ asset that can hedge against inflation and currency fluctuations. Investors can invest in gold in several ways, including buying physical gold (like coins or bullion), purchasing gold exchange-traded funds (ETFs), or investing in gold mining stocks.

The gold spot price is a single value based upon weight of pure gold. All digital gold is based upon 100% purity and so the full spot price applies. For physical gold, to calculate the value of different gold carats, the relevant percentage of gold is applied, for example 18 carat gold is worth 75% of the live price of gold.

Gold Value Vs Return

When selling gold to a commercial buyer such as a jeweller, cash converter or gold pawn broker, the amount you receive in exchange for your gold will take account of the profit margin they will naturally look to earn after recycling, scrapping or retailing the gold. With digital gold these overheads don’t apply and the value expected will be closer to market value dependent upon your trading partner, a point we will consider further in the next section.

3. How to Sell Gold

Selling Gold Jewellery

Local Jewellers: Local jewellers often buy and sell second hand jewellery and sometimes other gold forms such as coins. Visit reputable jewellers in your area and enquire about their gold buying policies. They will assess your jewellery based on the purity, weight, and current market prices, offering you a price based on their evaluation. Jewellery by renowned designer brands attracts celebrity status and remains highly desirable as secondhand. Valuation for such pieces should also take account of demand, ownership history and special edition status.

Pawnshops: Similar to local jewellers, selling gold in a pawn shop involves valuation of purity, weight and heritage. For most gold jewellery a pawn shop gold price will be relative to the scrap value of gold and offers a competitive option. As a specialist in this field the bulk buying from numerous gold sellers enables keen valuations and settlements. Leading gold pawn brokers will offer an online service to avoid the need to visit in person if preferred.

Online Marketplaces: Online marketplaces such as eBay provide platforms for selling gold jewellery directly to interested buyers. Take clear, high-quality photos of your jewellery and provide detailed descriptions including purity, weight, and any relevant certifications. As an independent gold seller you will need to establish trust with prospective buyers which may take time, whereas selling to jewellers or gold pawn brokers will provide instant cash. Always weigh up the potential higher return with the effort required to achieve it versus other selling options.

Gold Buying Events: Occasionally, jewellers or cash converter companies host gold buying events where individuals can sell gold jewellery for cash. These events may take place at hotels, community centres, or other venues for a limited time, following the trend for ‘pop up’ retail events, While convenient, exercise caution and ensure the event organisers are reputable and transparent about their evaluation process.

Auctions: Auction houses such as Sothebys, Christies and Bonhams regularly hold specialised sales featuring antique and vintage jewellery, including pieces crafted from gold. These auctions provide collectors, enthusiasts, and individuals interested in unique and historical jewellery pieces with the opportunity to acquire rare and valuable items. These auction houses typically provide detailed catalogues of their sales, allowing prospective buyers to preview the items available for auction and participate in bidding either in person, online, or through telephone bidding. Additionally, they often employ specialists who can provide insights into the history, craftsmanship, and the specific value of the jewellery on offer beyond the market rate for gold.

Selling Gold Coins

Gold coins are primarily valued for their precious metal content and collectible appeal. They are minted by government or private mints and typically feature standardised weights, purities, and designs. Gold coins often hold intrinsic value beyond their gold content, such as historical significance or rarity. How to sell gold coins can differ to how to sell gold jewellery as bullion traders are one of the most common buyers. That said, some jewellers and gold pawnbrokers will also buy gold coins. Bullion dealers view gold coins as a long-term investment for their business. Gold has maintained its value and purchasing power over millennia, making it a reliable store of wealth. By acquiring gold coins, dealers position themselves to benefit from potential appreciation in gold prices over time.

How to sell gold Sovereigns or Krugerrands shares similarities with selling other types of gold coins, but there are specific considerations to keep in mind due to the unique characteristics of these coins.

Recognition and Popularity: Gold Sovereigns and Krugerrands are among the most widely recognised and traded gold coins globally. They have a long history and established reputation for purity, quality, and consistent weight. This widespread recognition can make them easier to sell compared to lesser-known coins.

Bullion Value: Both Sovereigns and Krugerrands are considered bullion coins, meaning their value is primarily based on their gold content rather than collectible factors. When selling these coins, the seller can typically expect to receive a price close to the current gold spot price, adjusted for the coin’s purity and weight.

Purity and Weight: Sovereigns, a classic British coin dating back centuries are minted with 22-carat gold, containing 91.67% pure gold weighing approximately 7.98 grams. Therefore, the actual gold content in a Sovereign is approximately 7.32grams. A Gold Krugerrand is a South African gold bullion coin that has been minted since 1967. By comparison to a gold Sovereign, a gold Krugerrand weighs 33.83 grams, and with the same 22 carat purity, the gold content in a Gold Krugerrand is approximately 31.1035 grams.

Selling Digital Gold

Digital gold typically refers to gold-backed digital tokens or certificates that represent ownership of physical gold held by a custodian. Selling digital gold involves converting your digital gold holdings into fiat currency (such as GBP, EUR, USD, etc.) or other assets. Digital gold typically refers to gold-backed digital tokens or certificates that represent ownership of physical gold held by a custodian.

The selling rate for digital gold can vary depending on the platform or service provider you use, market conditions, liquidity, fees, and other factors. In general, the selling rate for digital gold or may closely track the gold spot rate or ‘gold share price’, but there can be differences due to various considerations:

Platform Fees: Some platforms or service providers may charge fees or commissions for buying or selling digital gold. These fees can vary depending on the platform’s pricing structure and may affect the selling rate you receive compared to the gold spot rate.

Spread: The spread refers to the difference between the buying and selling prices of digital gold on a particular platform. Platforms may offer digital gold at prices slightly above (for selling) or below (for buying) the prevailing gold spot rate to cover their operating costs and generate revenue. A wider spread can result in a selling rate that deviates more from the gold spot rate.

Market Liquidity: The liquidity of the digital gold market can impact selling rates. In markets with lower liquidity, it may be more challenging to sell digital gold at prices closely aligned with the gold spot rate, potentially resulting in wider spreads or lower selling rates.

Market Demand: Demand for digital gold, influenced by factors such as investor sentiment, economic conditions, and geopolitical developments, can affect selling rates. Higher demand may drive prices closer to the gold spot rate, while lower demand may result in discounts or premiums.

In addition to Digital Gold Providers such as Bullion Vault or Chards digital gold bought and sold through brokers. These platforms allow investors to buy and sell shares of investment products backed by physical gold or gold derivatives. Examples of brokerage platforms that may offer digital gold exposure include Hargreaves Lansdown and Interactive Brokers.

Before selling digital gold on any platform, it’s essential to research and compare available options, consider factors such as fees, liquidity, security, and regulatory compliance, and choose a reputable and reliable service provider that meets your trading needs and preferences. Additionally, be aware of any tax implications associated with selling digital gold and comply with applicable tax regulations. Commonly, but not always, values closest to the gold selling rate today can be secured by selling through the platform where the digital gold is held. A good example is the Digigold service by Royal Mint where digital gold selling rate is preferential for it’s own investors versus the charges for selling digital gold held elsewhere.

Selling Gold Versus Silver or Platinum

As precious metals, gold, silver, and platinum do share some attributes, but they also have distinct characteristics that influence their market demand, price dynamics, and value factors. How to sell gold and silver, and indeed platinum, is fundamentally based upon the same selling process and places. Valuation is also aligned, using weight and purity measures. Gold is however typically more liquid and widely accepted than silver or platinum, making it easier to sell in various forms and quantities.

In brief, gold is valued for its purity, weight, and global acceptance as a form of currency and investment. Its stable and most recently strong performance make it a popular choice for preserving wealth. Silver is better known for its industrial utility and scarcity, as well as a lower investment appeal. Its value is influenced by factors such as industrial demand, investor sentiment, and macroeconomic conditions. And finally platinum is valued for its rarity, density, and industrial applications. Its value is determined by supply and demand dynamics, particularly in the automotive industry, as well as investor perceptions of its investment potential.

Selling Gold – Buyer Reputation and Reviews

When selling gold it is important to choose reputable buyers or platforms to ensure a fair and secure transaction. Online presence, physical premises, customer reviews and trading credentials all help to assess your options. Below are some specific pointers which will help you to avoid scams and pitfalls.

Unlicensed or Unregulated Buyers: Avoid selling gold to individuals or businesses that operate without proper licensing or regulation. Licensed gold dealers, gold pawn brokers and reputable online platforms adhere to legal requirements and industry standards, providing transparency and consumer protection.

Unverified Online Buyers: Exercise caution when dealing with online buyers, especially those with limited or no verification processes. Avoid selling gold to unverified individuals or platforms that lack credible reviews, contact information, or physical addresses. Verify the legitimacy of online buyers before conducting transactions to avoid potential scams or fraud.

Street or Door-to-Door Buyers: Be wary of selling gold to buyers who approach you on the street or at your doorstep, particularly without prior arrangement. While some legitimate gold buyers operate through storefronts or mobile services, unsolicited approaches may indicate potential scams or dishonest practices. Verify the credentials and reputation of buyers before engaging with them.

High-Pressure Sales Tactics: Avoid sellers who use high-pressure sales tactics or make unrealistic promises to persuade you to sell your gold quickly. Reputable buyers provide transparent pricing, fair valuations, and sufficient time for sellers to consider their options without feeling rushed or coerced.

Offers Below Market Value: Be cautious of offers significantly below the prevailing market value for your gold. While buyers may negotiate prices based on factors such as purity, weight, and market conditions, excessively low offers may indicate unscrupulous practices or attempts to exploit sellers’ lack of knowledge.

Lack of Transparency: Avoid sellers who demonstrate a lack of transparency regarding pricing, valuation methods, fees, or terms of sale. Reputable buyers provide clear and detailed information about their pricing structure, appraisal process, transaction fees, and payment methods, enabling sellers to make informed decisions.

No Written Agreement: Refrain from conducting gold transactions without a written agreement or receipt outlining the terms of the sale. A written contract should specify the agreed-upon price, quantity, purity, payment method, and any other relevant details to protect both parties and ensure accountability.

By avoiding these potential pitfalls and conducting due diligence when selecting buyers or platforms, you can minimise the risk of encountering fraudulent or unethical activity when selling gold. Choose reputable, licensed, and transparent buyers who prioritise customer satisfaction and adhere to industry standards. As with all buying and selling it is also always good to obtain multiple quotes or offers in order to decide which provider delivers the overall best value and service.

4. Sell Gold or Pawn Gold with Suttons & Robertsons

As gold pawn brokers since 1770 we are proud of our longstanding reputation as a trusted organisation, a place you can rely upon for a fair price and exceptional service for gold loans and when selling gold. Our London stores provide private meeting rooms to discuss potential gold sales or gold pawn quotes so that you can be assured of discretion at all times. Alternatively our online pawn and selling services offer the convenience of remote valuations, secure postal or courier asset delivery and bank transfer settlement.

Valuation

In line with Sections 2 and 3 of this guide, our valuations for both buying gold or offering loans secured with gold, will be linked to the gold spot price. Additionally in the case of jewellery, any further intrinsic value of the specific item(s) will be taken into account. Some jewellery designs by Tiffany, Cartier, Boucheron, Bvlgari, Boodles and other elite brands can be highly valuable. Sometimes the desirability and demand of these pieces can outweigh the physical gold value.

The Pawn Gold Price Per Gram UK, sometimes applied through a Pawn Shop Gold Calculator, varies by gold pawn broker. We typically offer gold pawn loans up to 70% of the gold spot rate value, taking account of the weight and purity (carat) of your gold. This loan to value ratio (LTV) compares very favourably with our competitors who may only offer up to 60%. If you are new to pawnbroking our online guide for beginners shares more information to help you understand our terms and processes.

In the case of online enquiries to sell gold or pawn gold, our initial quote will be based upon information you provide, which will be subject to validation upon receipt of your asset.

Security

After acceptance of an initial online quote we will arrange secure and insured postal delivery or courier collection of your gold. These same arrangements apply to any return of your assets either due to failed authentication or following repayment of a gold pawn loan.

When holding your assets as security for a gold pawn loan, all items are securely held in our London vaults, also fully insured.

Authentication & Validation

Our valuations and final offers, whether in person or via our online service will be subject to thorough authentication and validation of your gold items. Weighing gold accurately is crucial to both us and you – our specialist jewellery and gold scales will ensure pinpoint weight measurement, an important part of this step in the selling or pawning gold process.

Technical toolkits support our decades of experience in confirming authenticity and purity of gold. From knowledge of the feel, smell and colour of gold to advanced testing solutions, we can be sure we are offering a quote commensurate with your gold value.

Once we have reached agreement, you formally accept our quote, and we are in receipt of your gold asset(s) we will bank transfer sale settlement or your loan value without delay. Call us on 0800 038 9839 or contact us to get a quote now. Our friendly team will be available to help you unleash the value of your gold.